Once again, we bring you the cancellations and pick up data from May, and we have extended the period until end August in order to determine if we can identify any change in the trends in the longer term.

Please note: this post was prepared prior to the announcement by the Minister of Work about the possible restrictions on opening of hotels. Once we receive more clarity on the government plans for the sector, the data could change radically. We will keep you updated as the situation develops.

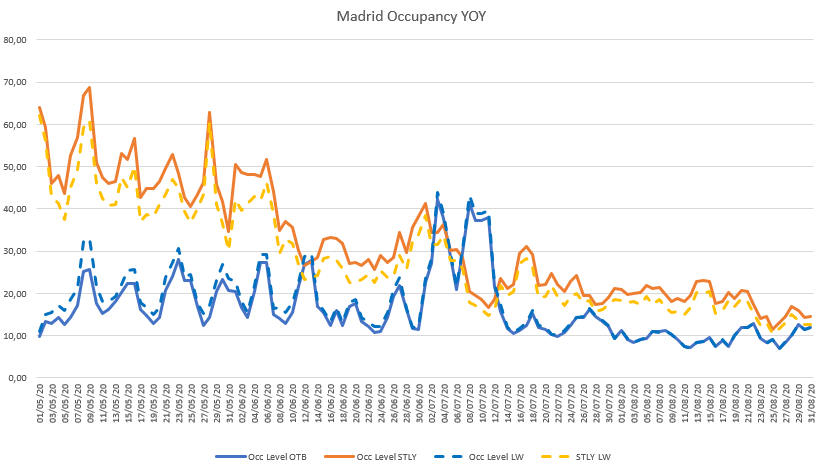

Madrid

We have added into the graph the comparison with last week in terms of the Same Time Last Year (STLY) – this is shown on the dotted orange line.

Conclusions we can draw from this week:

There is no significant change in the booking patterns since last week.

In May the trend of negative pick up has continued. This is the 5th straight week that there are more cancellations than bookings, leaving the occupancy levels below 20% in many cases. Bearing in mind the more than likely extension of the state of alarm, it seems more and more clear that most hotels will not actually open in Madrid for some months.

There is no relevant change in the situation with cancellations from mid-June onwards: clients are still not cancelling their reservations for this period.

However, looking at the STLY data from June onwards, also nobody is making reservations: the gap is continuing to widen compared to last week, showing that last year people were already booking for this period. This would also suggest a negative outlook on these months.

We can see a peak of occupancy in the first days of July. This coincides with the celebration of Gay Pride, however this event has been postponed, so we should expect to see more cancellations here soon. Revenue Managers need to keep on top of this.

This is the first time we have looked at August data. At present the trends follow almost exactly the same pattern as July, except that the gap versus STLY is currently smaller, since the volume of reservations last year for these dates was not significant. (We should bear in mind that August is always low season in Madrid).

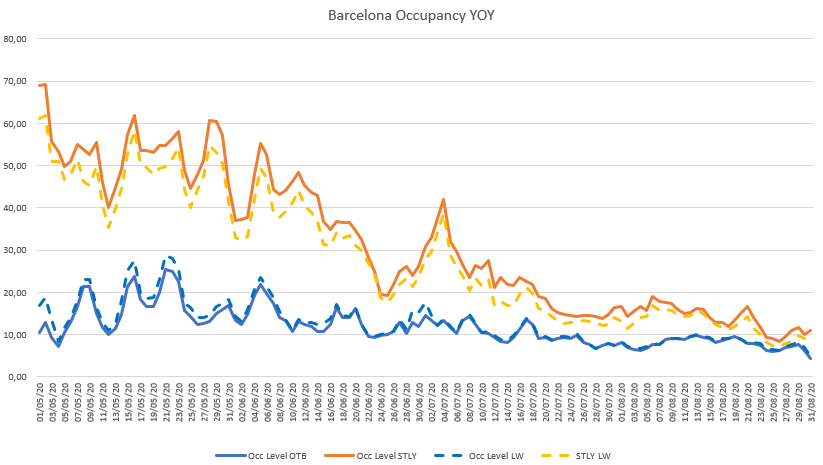

Barcelona

The situation is very similar to Madrid, both in terms of negative trends in May (once again -2 percentage points since last week) and some stabilization in the rate of cancellations from the middle of June onwards.

Similarly, we can also see a gap opening up in the STLY data for June and July, also suggesting that these months will be significantly impacted also.

This is the first time we have looked at August data. At present the trends follow almost exactly the same pattern as July.

Availability and pricing

We also took a look at the availability shown by hotels in these markets, and we can see that there is quite a high percentage of hotels closed for sale in May: 43% of the hotels in Madrid and 49% of those in Barcelona.

For the following months the vast majority of properties are still showing availability, however this may change once the government´s plan for the tourist industry becomes clearer. We will update this in future blogs.

In terms of pricing we see little change – it seems like nobody is really looking at this right now and we would strongly recommend you not to neglect this area. Remember :